‘A major godsend’

Complementary plans provide peace of mind in fight against cancer

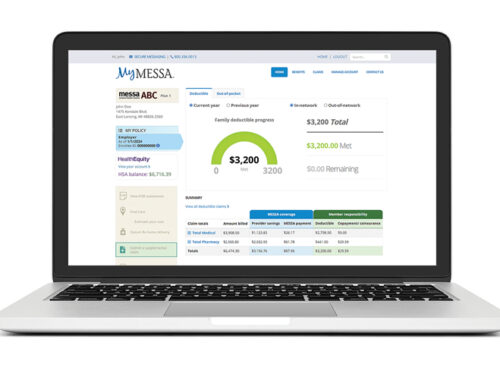

When it was time for Patricia Blevins to renew her Essentials by MESSA health plan, she pored over all her options and came across something intriguing and new: MESSA’s supplemental plans.

“I signed up for it because it was a really good deal,” said Blevins, a preschool teacher for more than 40 years at Perry Early Learning Center in Ypsilanti Community Schools. “I just saw that it was a new benefit that was being offered and I thought well, maybe this is something worth doing, not thinking in a million years I was going to be using it.”

To help provide financial relief during tough times, MESSA offers supplemental accident, critical illness and hospital indemnity plans to complement MESSA’s medical coverage. The supplemental plans pay out cash benefits to members for covered illnesses or injuries. Members can choose one plan or bundle all three for the ultimate protection.

“That was a major godsend for me. I could focus on getting treatment instead of worrying about how I’m possibly going to pay for any of this. When I signed up for it, I had no idea I had any health issues to address.”

Blevins signed up for all three plans, despite being in good health at the time.

Well, fast forward about a year and the unexpected happened: Blevins, 62, was diagnosed with cancer.

Her first clue that something was wrong came when she suddenly passed out after spending some time poolside with a friend. She chalked it up to getting older.

“I was going, ‘This isn’t like me,’” she said. “My thought process was ‘Oh my goodness, aging is worse than I thought.’”

Later in the month, she felt exhausted and light-headed again shortly after returning home from a trip to Maine. She managed to call her husband, Ron, into the family room before she fainted again.

“So now I’m thinking something is really kicking my butt here,” Blevins said. “This isn’t a matter of I’m too warm or I’m pushing myself too much. This is a problem.”

After a series of blood tests, Blevins received a call from her physician saying her hemoglobin was low and she needed a transfusion right away. And that’s when her fight against cancer began.

After her diagnosis, Blevins called MESSA to explore her options. Her physician wasn’t very experienced in her treatment, and she knew that Mayo Clinic had providers with expertise in her exact procedure. She asked about receiving treatment at Mayo Clinic and found out that it’s an in-network facility. In less than a week, she was in Rochester, Minn., going through a series of evaluations and focused on getting healthy. She spent 10 days at Mayo Clinic after her initial surgery.

After several tests, treatments, surgeries and hospital stays, medical bills and other personal expenses stacked up quickly. Blevins found herself in need of a financial safety net.

While her MESSA health plan covered 80% of her medical bills, her portion of the cost was $9,000 out of pocket. Blevins also had to pay $17,000 for airfare, hotel and food. That’s where the supplemental plan kicked in, paying her $10,000 from her critical illness plan and about $2,000 from the hospital indemnity plan. It was money back in her pocket when she needed it most to help offset her expenses.

“That was a major godsend for me,” Blevins said. “I could focus on getting treatment instead of worrying about how I’m possibly going to pay for any of this. When I signed up for it, I had no idea I had any health issues to address.”

Patricia Blevins, a MESSA member and a longtime pre-school teacher at Perry Early Learning Center in the Ypsilanti Community Schools District, talks about how MESSA’s supplemental plans provided a financial safety net when she was battling cancer.

The last thing anyone wants to worry about when they’re fighting for their life is how to cover all of the extra expenses. Blevins said MESSA’s supplemental plans gave her the peace of mind she needed on her journey to recovery. She said she has spoken to her union about her experience with the supplemental plans, and she’s asked her MESSA field representative, Monica McKay, to speak about it with her colleagues also.

“I don’t think there’s an insurance that can beat MESSA because MESSA really cares about their members,” Blevins said. “Whenever I needed a place to go for resources, MESSA was really good about it. I appreciate that MESSA had this available for their members.”

MESSA offers three supplemental plans

- Accident: Pays cash benefits if you or a covered dependent experience an accidental injury on or off the job. Includes injuries from kids’ organized sports.

- Critical illness: Pays cash benefits if you or a covered dependent are diagnosed with a covered illness or condition. Also pays $50 per covered individual for certain preventative screenings and care.

- Hospital indemnity: Pays a lump sum benefit for admission and a daily benefit for a covered hospital stay due to illness, injury, surgery or childbirth.

How to get them

There are two ways to get MESSA’s supplemental benefits:

- Negotiated supplemental benefits: Your bargaining unit can negotiate with your employer to provide all employees in your group with an employer-paid bundle consisting of accident, critical illness and hospital indemnity coverage. This can be a particularly attractive option for groups with higher-deductible medical plans.

- Optional supplemental benefits: If your employer provides MESSA’s optional benefits, you can choose from an accident plan, a critical illness plan, a hospital indemnity plan, or a bundle of all three and pay via payroll deduction.

To learn more visit messa.org/supplemental or call your MESSA field representative at 800-292-4910.