Introducing MESSA Balance+

MESSA’s newest health plan saves you money while giving you peace of mind

MESSA has a new health plan available this year, giving you more options than ever when it comes to choosing the right plan for your needs and your budget.

MESSA Balance+ includes a health savings account, as well as MESSA’s bundle of supplemental plans that pay cash for covered incidents. It also features a robust prescription plan that includes an extensive list of free preventive medications.

As with all MESSA plans, Balance+ boasts the largest network of doctors, hospitals and other providers in Michigan.

The details

MESSA Balance+ features a lower premium — the amount you pay out of your paycheck for health insurance — while providing the exceptional health benefits and service you expect from MESSA.

It has the lowest deductible allowed — $1,600 for single and $3,200 for family — with an HSA-eligible plan. Once you meet the deductible, you’ll pay these set copayments for visits and coinsurance for services:

- $10 copayment for virtual 24/7care for minor illnesses or injuries and for mental health visits with MESSA’s approved online platform

- $25 copay for office visits, such as with your primary care physician, OB-GYN and pediatrician

- $25 copay for chiropractic and osteopathic manipulations

- $50 copay for specialist visits

- $50 copay for urgent care

- $200 emergency room copay if you’re not admitted to the hospital

- 20% coinsurance for services such as lab work and hospitalizations

We asked some of MESSA’s experts to explain the finer points of our new Balance+ plan, and here’s what they had to say:

“MESSA members asked for a plan that has a lower premium compared to our most popular plans, lower out-of-pocket costs, and a health savings account to save for retirement and reimburse members for deductible, copays and coinsurance. We heard our members, and we designed Balance+ to check off all those boxes. Then we went a step further and added in the bundle of supplemental plans.”

What is a health savings account?

MESSA Balance+ is what’s known as a high-deductible health plan. But don’t let that designation turn you off because it comes with a terrific perk: a health savings account (HSA).

An HSA is a tax-free savings account that you can use to pay for qualifying medical, vision and dental expenses. You can use your HSA to pay for deductible expenses, copays, coinsurance and more. It provides you with a triple tax savings — meaning you pay no taxes on contributions, earnings or withdrawals.

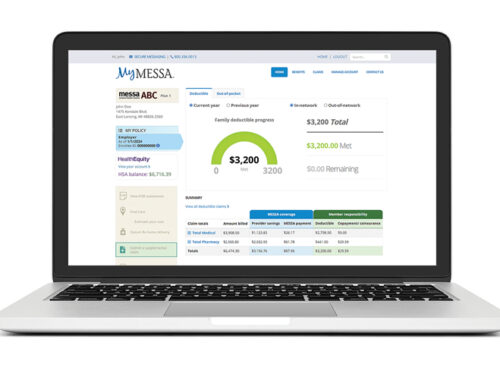

MESSA partners with HealthEquity for HSA administration, which offers an easy-to-use app and website to help you easily pay claims and maximize the benefits of your HSA.

“An HSA is great way to save for health expenses in retirement, while benefiting your bottom line now. It’s great that you don’t pay any taxes on it, and any unspent money carries over from year-to-year. With HealthEquity, you can invest your balance, allowing you to build a nest egg to cover health expenses down the road.”

What about those supplemental plans?

Balance+ includes MESSA’s three supplemental plans, giving you financial security during life’s unexpected events:

- Accident: Pays cash benefits if you or a covered dependent experience an accidental injury on or off the job. Pro tip: It covers injuries from kids’ organized sports with a 25% higher benefit payout.

- Critical Illness: Pays cash if you or a covered dependent are diagnosed with a covered illness or condition. Pro tip: Pays $50 per covered individual for certain preventive screenings and care that you receive every year.

- Hospital Indemnity: Pays a lump sum for admission and a daily benefit for a covered hospital stay due to childbirth, illness, injury or surgery.

“The supplemental plans provide financial security if you or a loved one is injured, gets sick or ends up in the hospital. You get paid cash benefits, and you can use the money however you need to. You can pay medical expenses, of course, but you can also use it to cover a car payment or the mortgage. It’s an extra layer of security so you can focus on getting well, without having to worry about paying the bills.”

MESSA Balance+ Rx

Balance+ features a robust prescription plan that includes an extensive list of free preventive prescriptions.

The plan breaks down prescription costs into flat-dollar copays for many generics and brand-name drugs, and 20% coinsurance for specialty medications. The structure of the prescription plan provides saving and helps members better budget for Rx expenses.

“The Balance+ Rx plan makes it easy for members to know what their costs will be for the most commonly used medications, and this plan is structured to help keep prescription costs down. When it comes to preventive medications, most of them will be on the free list and cost $0. As for coinsurance for specialty medications, a common specialty drug has a price tag around $44. Coinsurance on that medication is just $8.88.“MESSA Balance+ is a terrific plan that includes several features that would be a great fit for many of our members. I’m really excited that MESSA is introducing this plan.”

MESSA Balance+ is available for during open enrollment subject to your bargained benefits. It has a start date of Jan. 1, 2024.

Learn more at messa.org/Balance.